The West Virginia Opioid Reduction Act and Workers’ Compensation

In the spring 2018 session of the West Virginia Legislature, the West Virginia Opioid Reduction Act was passed. The law went into effect on June 7, 2018. The Act is not a workers' compensation statute, per se, meaning that it does not state that it applies to workers' compensation, but it does not expressly exempt workers' compensation from its coverage either.

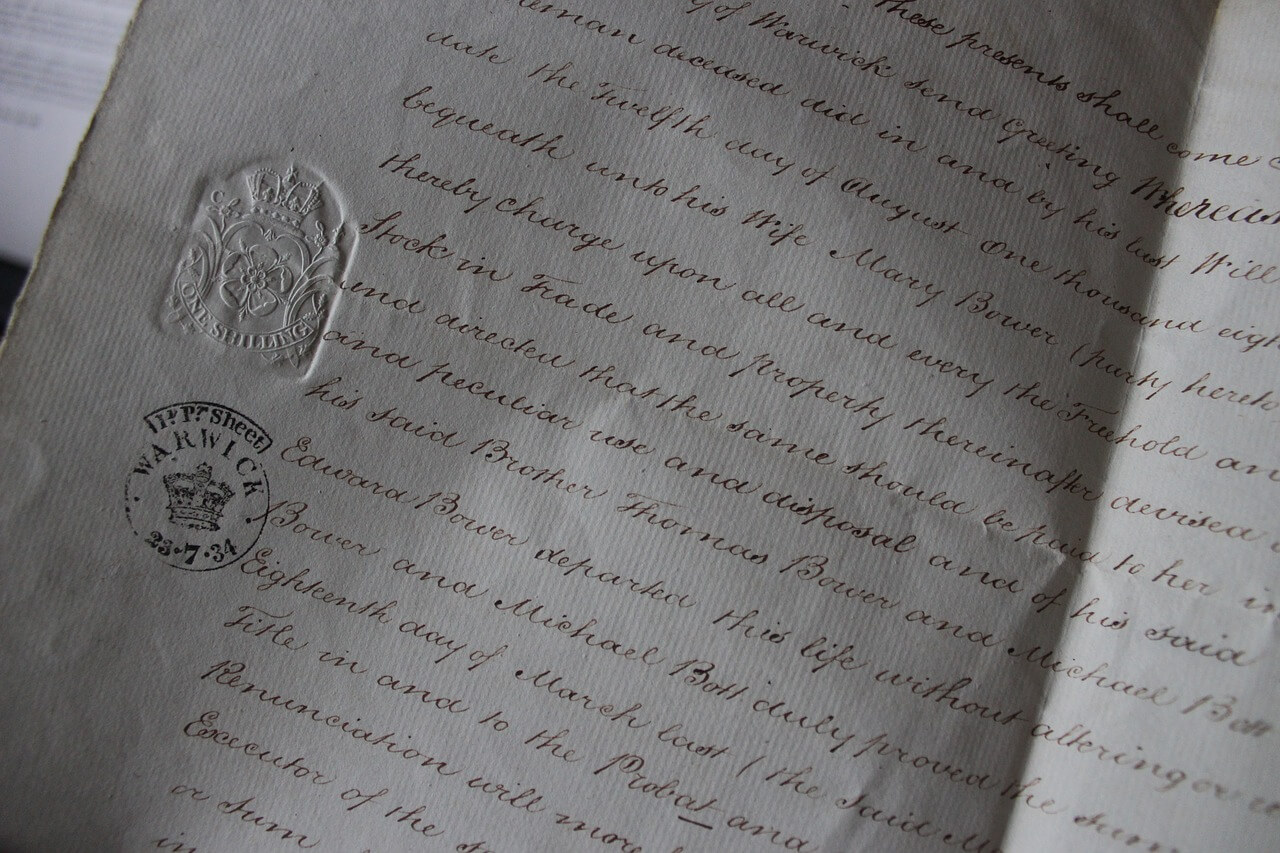

Your Year-End Estate Planning Checklist

You can't stop time from passing. As you are asking yourself how another year went by so quickly, take control of those things that you can control and that can give comfort and support to your loved ones: review your estate plan using this year-end estate planning checklist.

Changes in your health, your assets, or your family situation occur over the course of a year. Taking an afternoon to address what these changes mean for your estate plan can give you peace of mind in those long winter nights and provide comfort for your loved ones, too.

International Estate Planning for Individuals and Families

The adoption of the European Parliament's European Succession Regulation in 2012 simplified estate planning in the European Union. The regulation also resolved jurisdictional and choice of law issues. Unfortunately, no single overarching law governs international estate planning for other countries, including the United States.

WV Gun Laws for Businesses: The Impacts of HB 4187

Significant changes were made to WV gun laws for businesses in the 2018 legislative session. House Bill 4187, an amendment to West Virginia Code §61-7-14, created the Business Liability Protection Act. The Act effectively bans businesses from restricting the rights of individuals to stow a firearm in a personal vehicle on employer property under certain circumstances.

Charitable Estate Planning: Benefits for Both Donor and Recipient

Whatever your age, income, or family status, you have probably heard of and considered estate planning. An estate plan ensures that the money you work so hard to earn protects and benefits your loved ones. However, another planning option you may not have considered is charitable estate planning. Charitable estate planning is a rewarding way to benefit a worthwhile charity or organization, while reaping tax benefits for you and your family both now and later.