New Ruling Issued on WV Permanent Partial Disability Calculation

The West Virginia (WV) Supreme Court of Appeals issued a decision on June 10, 2024, in a case we argued on behalf of the employer and claim administrator.

Non-Compete Agreements in WV after the FTC Ban

The Federal Trade Commission (FTC) has issued a final rule that widely bans non-compete agreements in the United States (US) and retroactively invalidates agreements already in effect with few exceptions....

Changes to WV Workers’ Compensation and the WV Deliberate Intent Law

The 2023 regular session of the West Virginia (WV) Legislature produced changes to WV workers’ compensation and the WV deliberate intent law. Employers should be aware of these updates and how they may impact them and their employees moving forward...

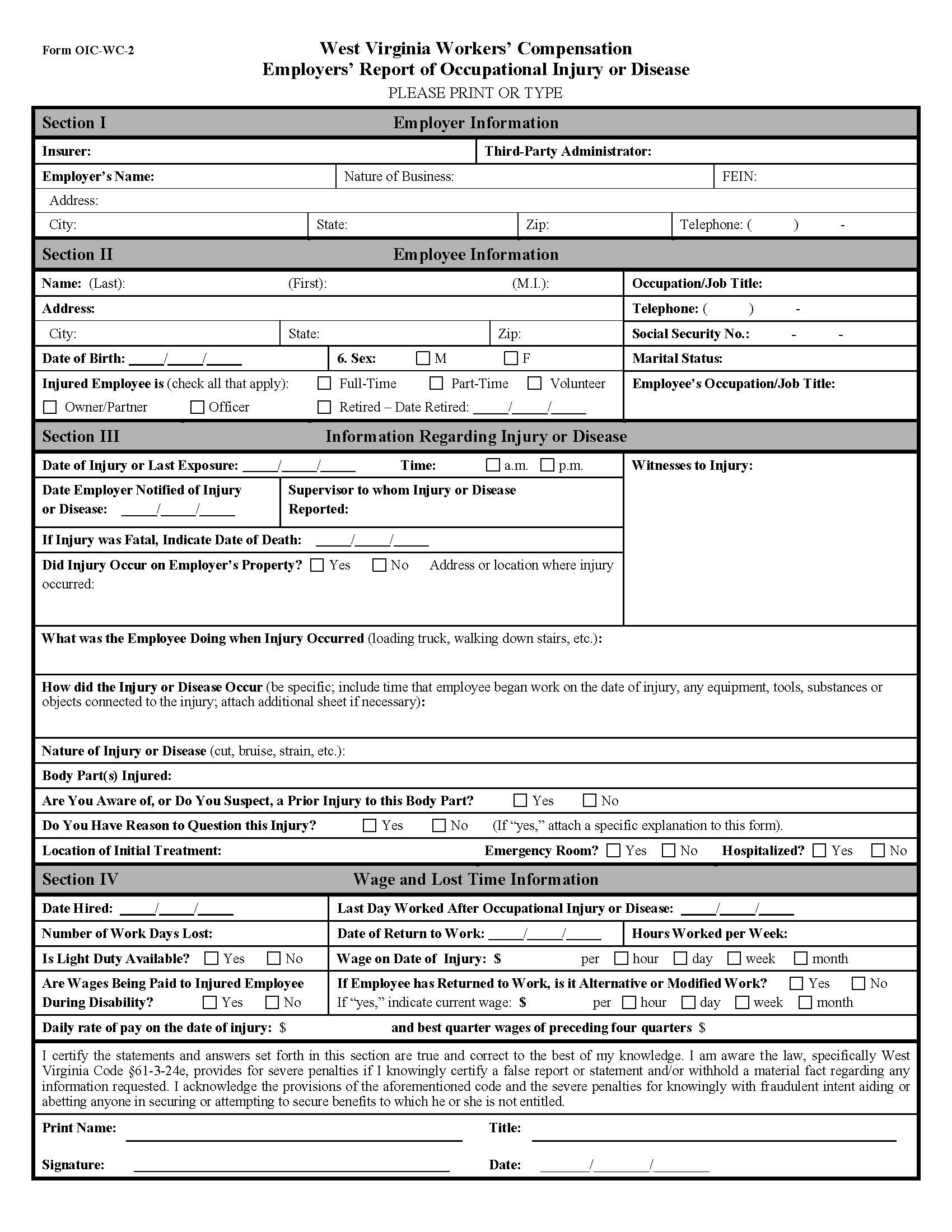

West Virginia Workers’ Compensation Rules: The Claims Process

To best inform employees and protect a company’s interests, West Virginia (WV) employers need to be aware of the general process for WV workplace injury claims. This process is established by state law and the West Virginia workers’ compensation rules...

Attachment of Black Lung Benefits in WV

Employers are generally aware that their employees’ wages can be garnished to pay child support, alimony, and other judgments or debts. However, when a current or former employee is receiving federal benefits, like Social Security or black lung benefits, various state and federal laws govern which benefits may be diverted to a creditor or payee and which may not. Attachment of black lung benefits in WV is allowed only under specific and limited conditions.