Changes to WV Workers’ Compensation and the WV Deliberate Intent Law

The 2023 regular session of the West Virginia (WV) Legislature produced changes to WV workers’ compensation and the WV deliberate intent law. Employers should be aware of these updates and how they may impact them and their employees moving forward...

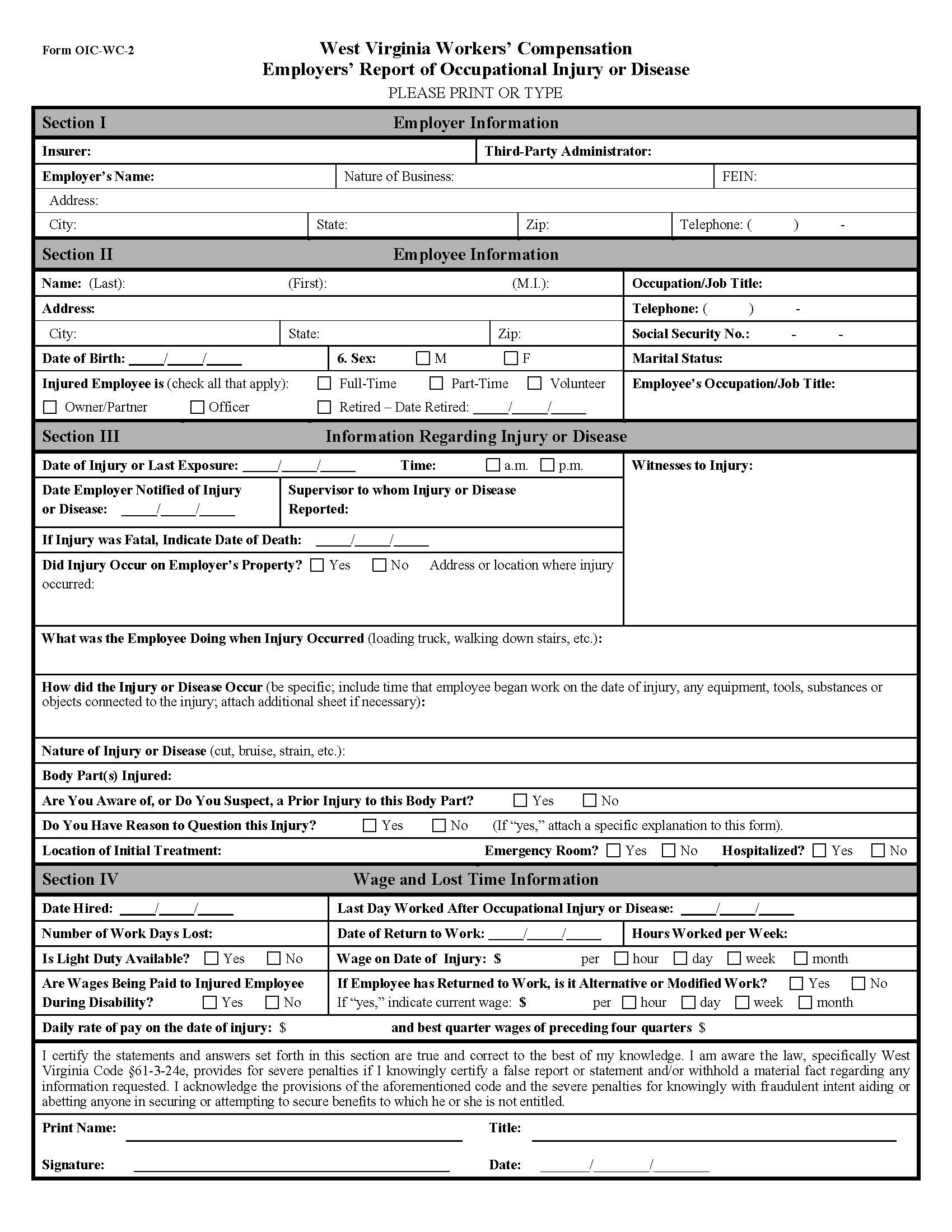

West Virginia Workers’ Compensation Rules: The Claims Process

To best inform employees and protect a company’s interests, West Virginia (WV) employers need to be aware of the general process for WV workplace injury claims. This process is established by state law and the West Virginia workers’ compensation rules...

Attachment of Black Lung Benefits in WV

Employers are generally aware that their employees’ wages can be garnished to pay child support, alimony, and other judgments or debts. However, when a current or former employee is receiving federal benefits, like Social Security or black lung benefits, various state and federal laws govern which benefits may be diverted to a creditor or payee and which may not. Attachment of black lung benefits in WV is allowed only under specific and limited conditions.

WV Employer Workers’ Compensation Rights and Responsibilities

A well-functioning workers’ compensation insurance system should provide for the needs of workers who are injured on the job while shielding employers from exorbitant premiums and unnecessary litigation. West Virginia (WV) has made progress in balancing these priorities in recent years although there is still work to do.

Workers’ Compensation Compensability in WV: Part Three

When an employee is injured at work in West Virginia (WV), the employer and workers’ compensation insurance provider, when applicable, may be responsible for covering the resulting expenses, including medical costs and lost wages. However, a variety of factors may be considered when determining workers’ compensation compensability in WV.