When you own a business, estate planning and business succession planning are emphatically entwined. Estate planning for business owners requires careful consideration of the impacts of your business succession plan on your life, retirement goals, and family. These objectives must be balanced and coordinated with your wishes for the future of the company, business partners, and employees.

Business Succession Planning and Estate Planning for Business Owners

Striking a balance between your estate planning goals and your business succession plan requires deliberation on your personal and business goals. How will you conclude your involvement with the business? Will the company and its assets be passed on to a family member or business partner, sold to an outside party, or dissolved? What legal and financial tools will you use to ensure a successful transition and maximize the benefits to all involved parties? Attorneys who specialized in estate planning and succession planning can help you answer these questions and determine which solutions are right for you and your business.

Setting Goals for Successful Estate Planning and Succession Planning

Successful estate planning and succession planning improve the odds that you can have the retirement you want, provide for your family in the years to come, and define your company’s legacy. Understanding and expressing your goals is the first step. The next is seeking out the right professionals to help with the tasks at hand.

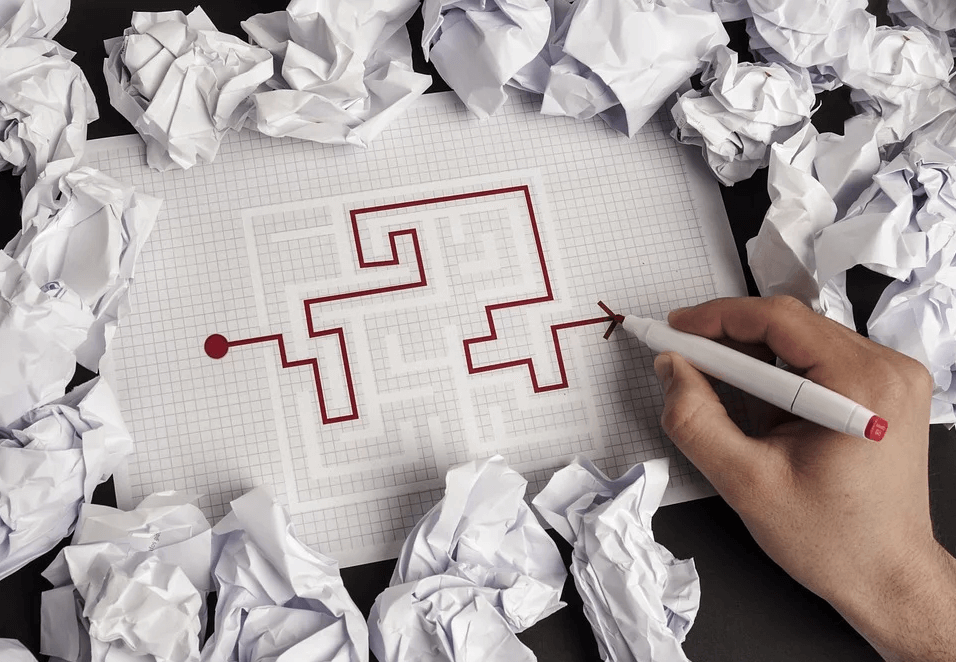

Advance planning—even ten to 15 years before your anticipated retirement—can improve your chances of achieving your goals. Planning can increase the current value of your business by providing a road map (and peace of mind) for current stakeholders and potential investors or buyers. It can also help reduce monetary amounts owed in estate or business taxes and foster a more efficient transition than would occur if you were to become disabled or pass away without a business succession plan.

Estate Planning for Business Owners: Making the Transition with a Business Succession Plan

Some of the important decisions in your business succession plan will depend on the type of company you own. Is your business owner-dependent, multigenerational, or marketable? There are unique considerations and tools that can be used in each of these business scenarios.

Another factor that will impact your estate planning and succession strategy is the point in time you hope to exit the business. Different financial and legal vehicles will be useful if you plan to transition from an ownership role into retirement than if you plan to maintain control of the business and pass on responsibility only upon your death or disability.

Business succession planning can include your wishes for your company in various areas. You can establish who is to obtain ownership, stock, and other ownership privileges, but you can also express your wishes for future management roles and practices. When you plan in advance, you can even have a role in determining how employees, customers, and business associates will be informed of changes when they occur.

Financial Vehicles and Options for Business Succession Planning

There are many options when it comes to the legal and financial tools used in business succession planning. These vehicles should be chosen with regard to your estate planning goals and which options best help you meet both personal and professional objectives.

-

Buy-sell agreements, including the following:

-

Trusts, including the following:

-

Business structures and partnerships, including the following:

These are just a few of the options available in business succession planning, and some options are used in correlation with other planning devices. While some are more complex than others, you should consult with an attorney and possibly a financial advisor, accountant, or tax specialist when choosing and implementing any of the options above.

Additional Considerations in Estate Planning for Business Owners

Executing successful estate planning and succession arrangements requires consideration of a number of elements. Valuation of the company is one important factor. How will you determine the value of your business and address differences that might occur between the date of assessment and your retirement, disability, or death?

Additional important factors include the content and details of your business succession plan and your estate plan. All of the documents must be drafted with clarity to help reduce your chances that disputes or litigation will arise after the plans are executed. Your estate plan should clearly reference your succession plan, and vice versa. And your estate planning and business succession planning documents and related policies or trusts should be reviewed and updated regularly to avoid problems that can result from inaccurate or out-of-date information.

Estate planning for business owners can be a complicated process. Mistakes can cause significant financial losses for you, your family, or your business. Anna M. Price is an estate planning attorney with the Huntington, West Virginia firm of Jenkins Fenstermaker, PLLC who would be happy to help you address the issues of estate planning and succession planning in West Virginia, Kentucky, or Ohio. Contact Anna by calling (866) 617-4736, or complete her online contact form to start planning today.